AI is reshaping the identity fraud landscape, helping cybercriminals deploy more sophisticated fraud schemes than ever, despite a global stagnation in fraud attempts.

The latest of Sumsub’s Identity Fraud Report, published on November 25, 2025, showed that while identity fraud has slightly decreased in 2025, with identity fraud attempts at 2.2% of all analyzed verifications worldwide – compared to 2.6% in 2024 – the most sophisticated of these attempts have jumped 180%.

Sumsub defines “sophisticated fraud” as attacks that combine multiple coordinated techniques such as synthetic identities (sometimes with the use of AI and deepfakes), layered social engineering, device or telemetry tampering and cross-channel manipulation.

Unlike more simple fraud schemes, which rely on a single method, these sophisticated attacks are “far harder to detect and contain,” noted the report.

Sumsub called this trend the “sophistication shift” of identity fraud – “a moment when fraud transitions from high-volume noise to fewer, sharper and more damaging attacks.”

“This matters because stable percentages can create a false sense of security. In reality, every successful fraud attempt now represents greater preparation, higher costs, and longer-term impact for victims and institutions alike,” the report also read.

Pavel Goldman-Kalaydin, Head of AI/ML at Sumsub, said this shift should prompt organizations and citizens to rethink their fraud prevention approaches. “The threat has shifted from quantity to quality, and resilience now depends on how quickly organizations can detect anomalies, analyse behavioural data and adapt their defences to emerging threats in real time.”

This is especially true in Europe, where the report showed that 37% of businesses rely on manual fraud prevention processes.

“The region’s mature digital identity programs and strict regulatory regimes are not reflected in day-to-day digital infrastructure,” the report noted.

Jacob Thompson, VP of Sales at Sumsub, also pointed to a gap between awareness and action.

“Despite greater awareness, the gap between recognition and real-world application remains problematic. Nearly three in five European consumers were victims of fraud in 2025. For now, the most visible shift is not in how much fraud exists, but how efficiently it is executed,” he said.

First and Third-Party Fraud Trends

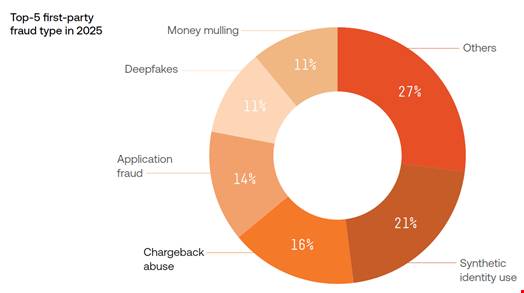

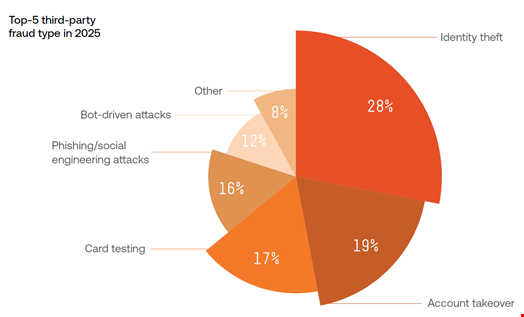

In the report, Sumsub differentiated between first-part fraud, where the perpetrator is the verified user themselves, and third-party fraud, where external attackers exploit or impersonate victims.

The top first-party fraud type identified in 2025 was synthetic identity use at 21%, followed by chargeback abuse (16%) and application fraud (14%). Deepfake fraud and money mulling – letting someone move stolen money through your bank account – were also high, at 11% each.

The top third-party fraud type for the same reported period was identity theft at 28%, followed by account takeover (18%) and card testing (17%). Phishing and social engineering attacks accounted for 16% of third-party fraud cases and bot-driven attacks, for 12%.

The two industries that were most hit by identity fraud in 2025 were dating apps, websites and online media, each representing 6.3% of global fraud cases, with romance scams driven by AI personas and deepfakes.

Financial services, cryptocurrency and professional services also saw high identity fraud rates, at 2.7%, 2.2% and 1.6%, respectively.

This represents a 232% year-on-year increase for professional services.

“Fraudsters targeted legal, consulting and accounting firms for their sensitive client data and reliance on manual onboarding,” the Sumsub report noted.

In 2025, fraudsters largely favored forging or impersonating ID cards, which represented 72% of forged ID documents, followed by passports (13%) and driver’s licenses (10%).

Fraud Cases Decrease in Western Countries, Increase Everywhere Else

Geographically, the Sumsub report showed a downward trend in most Western countries, with a 14.6% decrease in identity fraud in the US and Canada and a 5.5% decrease in Europe.

Meanwhile, the trend is going upward in other regions, with the Middle East recording the highest growth (+19.8%), followed by the Asia-Pacific region (+16.4%) and Latin America and the Caribbeans (+13.3%). Africa also saw a 9.3% growth in identity fraud cases.

The report also highlighted some countries where identity fraud originates or strikes the most.

Iraq, for instance, was identified as both the Middle East country with the highest fraud rates (9.7%) and the country where ID card forgery was the most prominent worldwide.

Zambia stood out in 2025 for having the highest number of applicants involved in fraud networks while Nigeria recorded the biggest share of synthetic documents, with 8% of all synthetic documents originating from the West African country.

Malaysia saw the biggest increase in identity fraud this year, with a 197% year-on-year growth, while the Maldives suffered a 2100% year-on-year increase in deepfake attacks, the highest for a single country.

The report combines the study of millions of verification checks, including over four million fraud attempts between 2024-2025, and findings from Sumsub’s Fraud Exposure Survey 2025, featuring responses from over 300 risk professionals and over 1200 Sumsub end users.