The cybersecurity sector recorded 346 funding rounds and 91 mergers and acquisition (M&A) transactions in 2023, according to cyber recruitment firm Pinpoint Search Group.

This equals 437 cyber deals in total and a 40% increase from 2022, which saw 303 deals signed in the sector.

However, the overall cyber investment raised in 2023 only amounted to $8.7bn, which represents a 40% decrease in fundraising from the previous year's $14.5bn.

Investors Shifted to Early-Stage Funding

According to Pinpoint’s research team, this decline in total funding raised can be attributed to a shift in investor focus in 2023.

“Investors adjusted their approaches, directing a greater portion of their funds into early-stage initiatives within the cybersecurity sector,” reads the report.

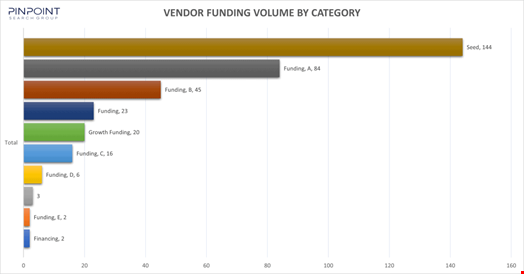

This trend is confirmed by the breakdown of rounds per type, with seed funding alone making up 42% of all funding deals.

Series A and series B rounds came second and third, representing 24% and 13% of all deals, respectively.

Additionally, the 91 M&A deals recorded in 2023 represent a 20% decrease from 114 transactions in 2022.

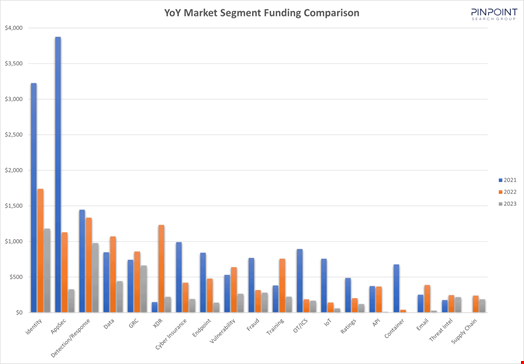

Top Funded Domains: Identity, Detection & Response and GRC

The top funded subdomains in 2023 were identity, detection & response and governance, risk, and compliance (GRC), although all three received less funding than in 2022 and 2021.

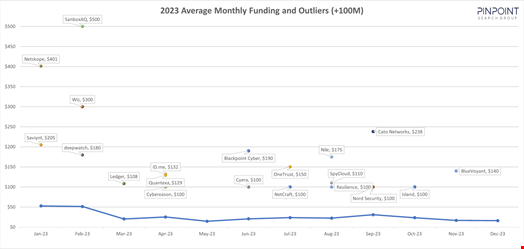

The start of 2023 recorded some of the highest funding rounds with Netskope raising $401m in January, Sandbox AQ securing a $500m growth round and Wiz achieving a $300m series B round in February.

Funding deals recorded by Pinpoint Search Group do not include rounds under $1m, grants and debt funding.

Undisclosed funding rounds are omitted starting from the third quarter of 2023.